Renters Insurance in and around Searcy

Looking for renters insurance in Searcy?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Searcy Renters!

Trying to sift through providers and deductibles on top of keeping up with friends, family events and your pickleball league, can be a lot to juggle. But your belongings in your rented townhome may need the impressive coverage that State Farm provides. So when mishaps occur, your souvenirs, linens and clothing have protection.

Looking for renters insurance in Searcy?

Coverage for what's yours, in your rented home

Why Renters In Searcy Choose State Farm

Renters often raise the question: Can renters insurance help protect you? Just pause to consider how difficult it would be to replace your belongings, or even just a few high-cost things. With a State Farm renters policy behind you, you don't have to be afraid of abrupt water damage from a ruptured pipe. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've left in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Brian Maddox can help you add identity theft coverage with monitoring alerts and providing support.

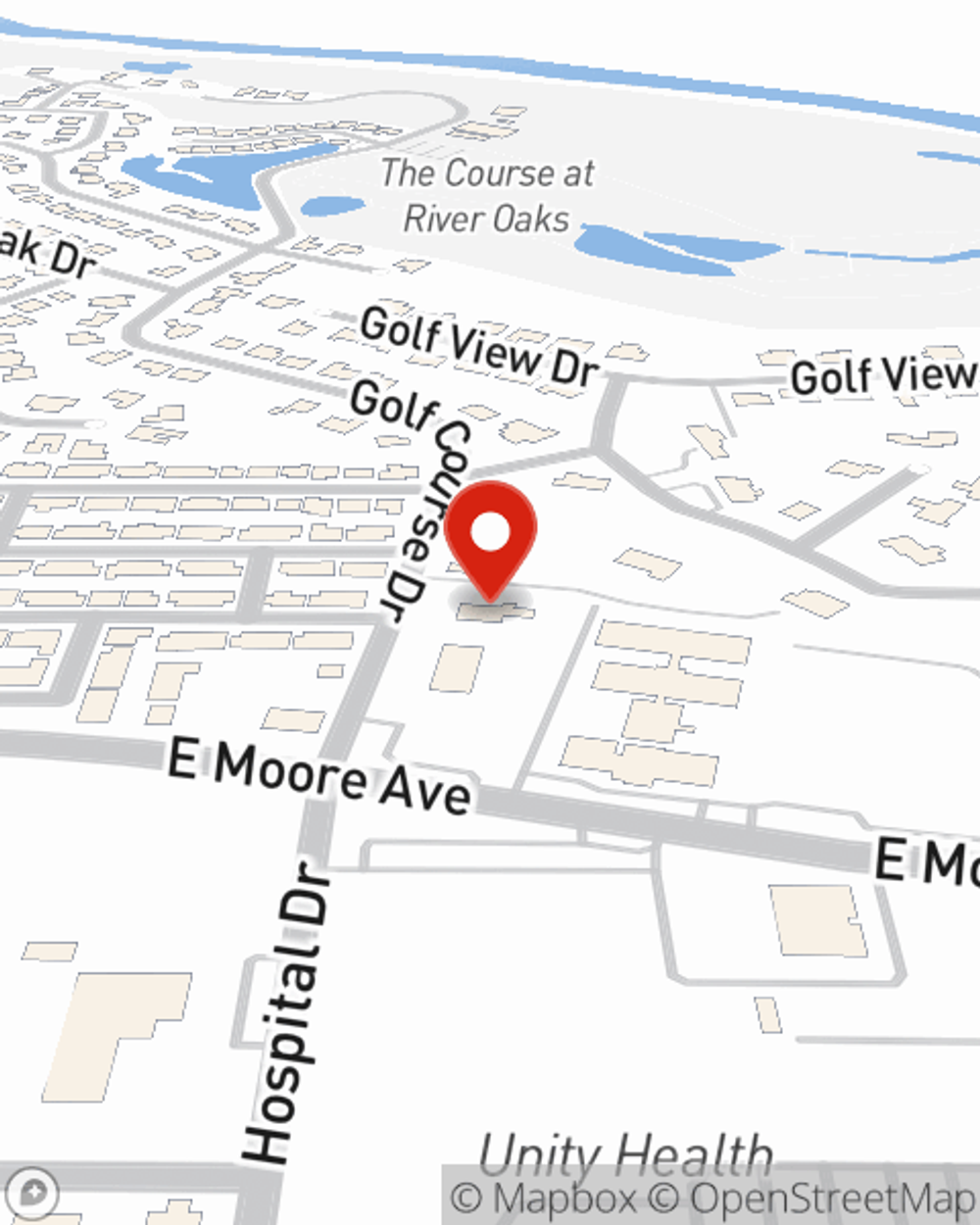

If you're looking for a committed provider that can help with all your renters insurance needs, visit State Farm agent Brian Maddox today.

Have More Questions About Renters Insurance?

Call Brian at (501) 268-1112 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Brian Maddox

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.